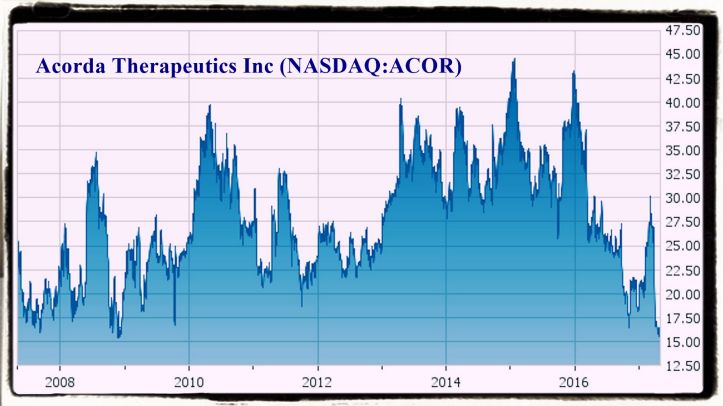

Acor 2 years historical price graph

Profile

Acorda Therapeutics Inc is a biopharmaceutical company. It is engaged in the identification, development & commercialization of novel therapies for the treatment of neurological disorders.

Website: http://www.acorda.com

Description

Acorda Therapeutics, Inc. is a biopharmaceutical company. The Company focuses on developing therapies that restore function and improve the lives of people with neurological disorders. As of December 31, 2016, the Company marketed three United States Food and Drug Administration (FDA)-approved therapies, including Ampyra (dalfampridine) Extended Release Tablets, 10 milligram (mg), a treatment to improve walking in patients with multiple sclerosis (MS). The Company also markets Zanaflex Capsules and tablets, FDA-approved as short-acting drugs for the management of spasticity, and Qutenza, an FDA-approved dermal patch for the management of neuropathic pain associated with post-herpetic neuralgia, also known as post-shingles pain. The Company has a pipeline of neurological therapies addressing a range of disorders, including Parkinson’s disease, migraine and MS. The Company’s product candidate, CVT-301, is a self-administered inhaled formulation of levodopa.

http://www.reuters.com/finance/stocks/companyProfile?rpc=66&symbol=ACOR.O

Shares of Acorda Therapeutics (NASDAQ:ACOR) opened at 16.15 on Monday. Acorda Therapeutics has a 52 week low of $15.30 and a 52 week high of $33.00. The firm has a 50-day moving average price of $21.11 and a 200-day moving average price of $21.22. The firm’s market capitalization is $739.78 million.

Financial Summary

BRIEF: For the three months ended 31 March 2017, Acorda Therapeutics Inc revenues increased 3% to $119.4M. Net loss increased from $520K to $18.9M. Revenues reflect Net product revenues increase of 2% to $112.6M, Royalty revenues increase of 30% to $4.5M, License revenue remaining flat at $2.3M. Higher net loss reflects Changes in fair value of acquired contin increase of 74% to $10.8M (expense).

Last Price Update

16.45 +0.30 (1.86%)

Real-time: 10:57AM EDT

NASDAQ real-time data – Disclaimer

Currency in USD

Range 16.05 – 16.70

52 week 15.30 – 33.00

Open 16.25

Vol / Avg. 229,683.00/1.39M

Mkt cap 798.85M

P/E –

Div/yield –

EPS -1.16

Shares 46.76M

Beta 1.73

Inst. own 106%

Market Capitalization Analysis

Market Capitalization can be thought of as the overall price to buy the company. Market Capitalization if basically the market value of the company’s shares outstanding. Market Cap is also the figure use to determine company’s size, as opposed to using sales or total asset figures.

Acorda Therapeutics, Inc. (ACOR) has a market capitalization of 755.14 Million which suggests the company is a huge company further suggesting that the shares of Acorda Therapeutics, Inc. (ACOR) are stable and safe compared to the lower market capitalization companies.

Daily Analyst Recommendations

A number of key analysts, polled by FactSet, shared their views about the current stock momentum. The forecast of 3 surveyed investment analysts covering the stock advises investors to Buy stake in the company. At present, 0 analysts call it Sell, while 6 think it is Hold. Recently, analysts have updated the overall rating to 2.6. 0 analysts recommended Overweight these shares while 0 recommended Underweight, according to FactSet data.

Disclaimer: The views, opinions, and information expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any company stakeholders, financial professionals, or analysts. Examples of analysis performed within this article are only examples. They should not be utilized to make stock portfolio or financial decisions as they are based only on limited and open source information. Assumptions made within the analysis are not reflective of the position of any analysts or financial professionals.