Nvax (Nasdaq). Novavax Inc is a clinica-stage vaccine company engaged in the discovery, development and commercialization of recombinant nanoparticle vaccines and adjuvants.

Novavax Inc. is based out of Garthersburg, MD and has some 355 employees. Its CEO is Stanley Charles Erck.

Novavax Inc. is a component of the Russell 2000. The Russell 2000 is one of the leading indices tracking small-cap companies in the United States. It’s maintained by Russell Investments, an industry leader in creating and maintaining indices, and consists of the smallest 2000 stocks from the broader Russell 3000 index.

Russell’s indices differ from traditional indices like the Dow Jones Industrial Average (DJIA) or S&P 500, whose members are selected by committee, because they base membership entirely on an objective, rules based methodology. The 3,000 largest companies by market cap make up the Russell 3000, with the 2,000 smaller companies making up the Russell 2000. It’s a simple approach that gives a broad, unbiased look at the small-cap market as a whole.

Website: http://www.novavax.com

Novavax is a clinical-stage biopharmaceutical company focused on the discovery, development and commercialization of recombinant nanoparticle vaccines and adjuvants. Using innovative proprietary recombinant nanoparticle vaccine platform technology, we produce vaccine candidates to efficiently and effectively respond to both known and emerging disease threats. Our vaccine candidates are genetically engineered three-dimensional nanostructures that incorporate recombinant proteins critical to disease pathogenesis. Our product pipeline targets a variety of infectious diseases with clinical vaccine candidates for respiratory syncytial virus (RSV) and Ebola virus (EBOV), and preclinical programs for Zika virus, seasonal influenza and a combination respiratory vaccine candidate, as well as other infectious disease vaccine candidates.

We are also developing proprietary technology for the production of immune stimulating saponin-based adjuvants through our wholly owned Swedish subsidiary, Novavax AB. Our lead adjuvant, Matrix-MTM, has been successfully tested in a Phase 1/2 clinical trial for our pandemic H7N9 influenza virus-like particle (VLP) vaccine candidate, and in a Phase 1 clinical trial for our EBOV vaccine candidate. Genocea Biosciences, Inc. (Genocea) has licensed rights to our Matrix technology and has conducted Phase 2 clinical trials with its herpes simplex 2 vaccine candidate using Matrix-M.

Novavax was incorporated in 1987 under the laws of the State of Delaware. Our principal executive offices are located at 20 Firstfield Road, Gaithersburg, Maryland, 20878. Our telephone number is (240) 268-2000 and our website address is www.novavax.com.

In 2015, Novavax received a grant from the Bill & Melinda Gates Foundation to develop its vaccine in certain low and middle income countries as part of the development of its RSV F Vaccine for maternal immunization. The Bill & Melinda Gates Foundation has awarded Novavax up to $89 million to support development of the RSV F Vaccine Phase 3 clinical trial in pregnant women, planned to initiate during the first quarter of 2016. This grant will also support regulatory licensing efforts, providing a path to World Health Organization (WHO) prequalification. Upon licensure, Novavax has agreed to make the RSV F vaccine affordable and accessible to people in the developing world.

In March 2015 the company completed a Phase I trial for its Ebola vaccine candidate.

In September 2016 the company announced that a Phase III trial of its RSV vaccine had failed to meet its endpoints, which caused its share price to fall from $8.34 to $1.40 and led the company to lay off 30% of its employees.

As of November 2016 its RSV F vaccine candidate was in three clinical trials.

Financial Summary

BRIEF: For the fiscal year ended 31 December 2016, Novavax, Inc. revenues decreased 58% to $15.4M. Net loss increased 78% to $280M. Revenues reflect Government contracts decrease of 93% to $2.2M. Higher net loss reflects General and administrative – Balancing increase of 59% to $38.5M (expense), Interest Expense increase from $241K to $13M (expense), Labor & Related Expenses in R&D increase of 65% to $11.2M (expense).

Recent Price History

0.752 -0.028 (-3.59%)

Real-time: 12:20PM EDT

NASDAQ real-time data – Disclaimer

Currency in USD

Range 0.75 – 0.78

52 week 0.73 – 8.49

Open 0.77

Vol / Avg. 2.88M/5.69M

Mkt cap 204.94M

P/E –

Div/yield –

EPS -1.03

Shares 271.95M

Beta 2.01

Inst. own 55%

Novavax, Inc. (NASDAQ:NVAX)’s performance this year to date is -34.13%. The stock has performed -7.78% over the last seven days, -38.06% over the last thirty, and -39.42% over the last three months. Over the last six months, Novavax, Inc.’s stock has been -46.79% and -84.88% for the year.

Gaithersburg vaccine company Novavax Inc. saw its share price jump at least 26 percent Tuesday – coming within a penny of the $1 threshold for the first time in a month – following its report of narrowed first-quarter losses.

http://www.bizjournals.com/washington/news/2017/05/09/novavax-shares-jump-on-news-of-narrowed-first.html

SMA

The simple moving average is the most common method used to calculate the moving average of prices. Novavax, Inc.’s 20-Day Simple Moving Average is -25.08%. Extending back, their 50-Day Simple Moving Average is -36.60%, looking even further back, their 200-Day Simple Moving Average stands at -72.70%.

Relative Strength Index

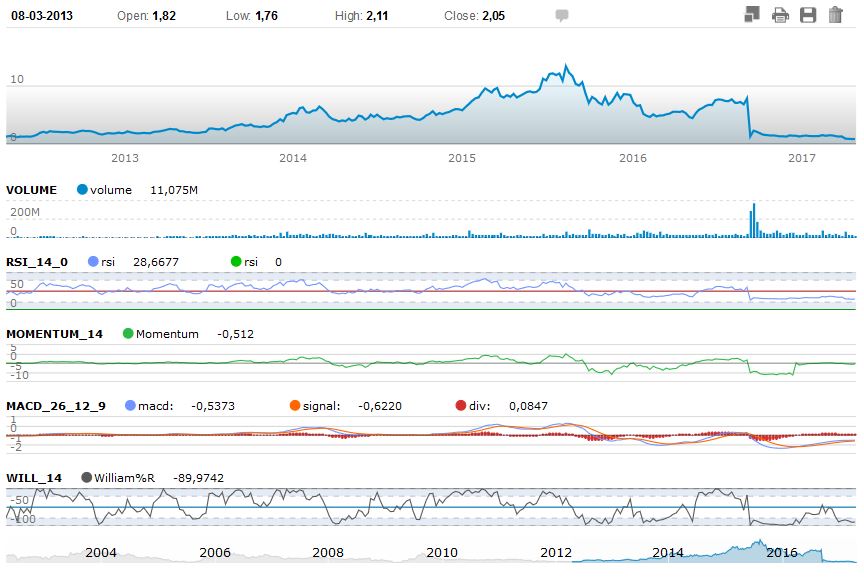

The Relative Strength Index (RSI), developed by J. Welles Wilder, is a momentum oscillator that calculates the speed and change of price movements. The RSI oscillates between zero and 100. Usually the RSI is considered overbought when above 70 and oversold when less than 30.

Relative strength index (RSI-14) for Novavax, Inc. (NVAX) is at 19.57.

Beta factor of the stock stands at 1.97. Beta factor is used to measure the volatility of the stock. The stock remained 3.94% volatile for the week and 8.84% for the month. Looking into the profitability ratios of NVAX stock, investor will find its ROE, ROA, ROI standing at -329.60%, -56.80%. Novavax, Inc. (NVAX) declared it will report its first quarter 2017 financial and operating results following the close of U.S. financial markets on Monday, May 8, 2017.

Price Target Update:

A price target is the projected price level of a financial security stated by an investment analyst or advisor. It represents a security’s price that, if achieved, results in a trader recognizing the best possible outcome for his investment. An influential analyst on Wall Street may give a stock that is currently trading at $60 a one-year price target of $90; however, there is no concrete way to calculate a price target. Different analysts and financial institutions use various valuation methods and take into account different economic forces when deciding on a price target. Analysts are estimating that Novavax, Inc. (NVAX) to hit $3.70 Price Target in next one year, this mean price is come up through the consensus of analysts. The Median price target for the stock is set at $1.50.

Consensus Price Target

The company’s consensus rating on Reuter’s scale improved from 2.62 to 2.71 during a month. Analysts set a 12-month price target of $3.58 a share. The target implies a 383.78% spike from where the shares are currently trading. Also, the current price highlights a discount of 1521.62% to analysts’ high consensus price target.

Analysts Recommendation

Novavax, Inc. (NVAX) has a mean recommendation of 2.67, according to data compiled by Zacks Investment Research. The recommendation scale measures the value from 1 to 5, where 1 means ‘’Strong Buy’’ and 5 stands for ”Sell”.

After the respiratory syncytial virus (RSV) failed clinical trial the company is now valued at little more than its cash on hand. There’s also an ongoing phase III study investigating the vaccine in pregnant women.

Keen investors are consistently searching for true bargains in the stock market. Finding these stocks can make the difference between a winning or losing portfolio. Shares of Novavax, Inc. (NASDAQ:NVAX) have come into focus as of late. In recent trading activity, company stock has moved -3.45% touching the price of $0.80. Moving forward, the investment community will be watching to see if shares can gain some positive momentum.

http://morganleader.com/bargain-hunter-investor-update-on-novavax-inc-nasdaqnvax/

Nasdaq, Inc. (NDAQ) Risk Assessment

Understanding Risk Grades Risk List Online Education

Understanding RiskGrades

Find out how RiskGradesTM can measure the financial risk of Nasdaq, Inc. (NDAQ) compared to other stocks using the stock analysis below.

Read more: http://www.nasdaq.com/investing/risk/

Is Novavax, Inc. Ready to Move higher?

The average investor might not have the time to monitor every single tick of a given stock, but taking a look at historical performance may help provide some valuable insight on where the stock may be trending in the future. Over the past week, Novavax, Inc. (NASDAQ:NVAX) has performed -7.78%. For the past month, shares are -33.06%. Over the last quarter, shares have performed -38.52%. Looking back further, Novavax, Inc. stock has been -47.80% over the last six months, and -34.13% since the start of the calendar year. For the past full year, shares are -84.91%.

NVAX: 5 years historical graph with some technical indicators

Disclaimer: The views, opinions, and information expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any company stakeholders, financial professionals, or analysts. Examples of analysis performed within this article are only examples. They should not be utilized to make stock portfolio or financial decisions as they are based only on limited and open source information. Assumptions made within the analysis are not reflective of the position of any analysts or financial professionals.