Prospect Capital Corporation (NASDAQ:PSEC) A stock with a very good monthly dividend.

Profile

Prospect Capital Corp is a closed-end investment company. It invests in senior and subordinated debt and equity of companies in need of capital for acquisitions, divestitures, growth, development, recapitalizations and other purposes.

Description

Prospect Capital Corporation is a financial services company. The Company primarily lends to and invests in middle market privately held companies. The Company is a closed-end investment company. Its investment objective is to generate both current income and long-term capital appreciation through debt and equity investments. The Company invests primarily in senior and subordinated debt and equity of private companies in need of capital for acquisitions, divestitures, growth, development, recapitalizations and other purposes. The Company makes investments, including lending in private equity sponsored transactions, lending directly to companies not owned by private equity firms, control investments in corporate operating companies, control investments in financial companies, investments in structured credit, real estate investments, investments in syndicated debt, aircraft leasing and online lending. The Company is managed by its investment advisor, Prospect Capital Management L.P.

http://www.reuters.com/finance/stocks/companyProfile?rpc=66&symbol=PSEC.O

Prospect Capital Corporation (NASDAQ: PSEC) is a leading provider of private debt and private equity to middle-market companies in the United States with a focus on sponsor-backed transactions and direct lending to established owner-operated companies. PSEC is a publicly-traded closed-end investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. PSEC completed its initial public offering in 2004.

PSEC invests primarily in first-lien and second-lien senior loans and mezzanine debt, which in some cases include an equity component. We provide capital to middle-market companies and private equity financial sponsors for refinancings, leveraged buyouts, acquisitions, recapitalizations, later-stage growth investments, and capital expenditures. PSEC’s portfolio is diversified across a wide variety of industries, including manufacturing, industrials, energy, business services, financial services, food, healthcare, and media, as well as many other sectors. PSEC also invests in the equity and subordinated debt tranches of collateralized loan obligations (CLOs).

Our investment objective is to generate both current income and long-term capital appreciation through debt and equity investments. We seek to maximize returns and protect risk for our investors by applying rigorous credit analysis to make and monitor our investments. PSEC is a yield-oriented investor and has paid a continuous, regular dividend to its investors since inception.

PSEC is managed by Prospect Capital Management L.P. (“PCM”). PCM has been registered as an investment advisor with the United States Securities and Exchange Commission since 2004. PCM, its predecessors and affiliates have a 25-year history of investing in companies and managing high-yielding debt and equity investments, using both private partnership and publicly-traded closed-end structures.

http://www.prospectstreet.com/

Financial Summary

BRIEF: For the six months ended 31 December 2016, Prospect Capital Corporation revenues decreased 11% to $363.3M. Net income totaled $182.2M vs. loss of $67.3M. Revenues reflect Structured credit securities decrease of 15% to $78.1M, Dividend Income, Cont. Entities decrease of 79% to $3.5M, Control investments (Net of foreign with decrease of 9% to $94.2M. Net Income reflects Net change in unrealized gains (losses) increase from $251.9M (expense) to $18.5M

Last Price Update

9.26 -0.04 (-0.41%)

Real-time: 11:28AM EDT

NASDAQ real-time data – Disclaimer

Currency in USD

Range 9.25 – 9.35

52 week 7.07 – 9.58

Open 9.32

Vol / Avg. 630,316.00/1.80M

Mkt cap 3.32B

P/E 9.37

Div/yield 0.08/10.80

EPS 0.99

Shares 359.30M

Beta 0.48

Inst. own 16%

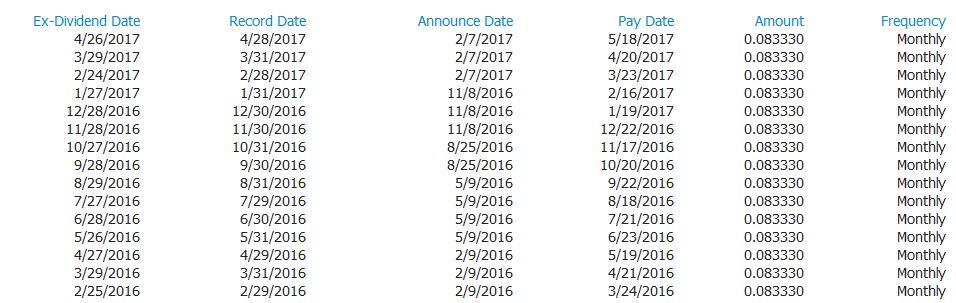

Dividends (NASDAQ – PSEC)

Description: Common stock, $0.001 par value

http://www.prospectstreet.com/CustomPage/Index?KeyGenPage=1073747400

Earnings per share Details about PSEC:

EPS in next five year years is expected to touch 5.00% while EPS growth in past 5 year was -26.70% along with sales growth of 36.10% in the last five years.

EPS growth in next year is estimated to reach 2.88% while EPS growth estimate for this year is set at -70.40%.

The price/earnings ratio (P/E) is 9.48 and the forward P/E ratio stands at 9.72. The price to earnings growth is 1.90 and the price to sales ratio is 17. It has a dividend yield of 10.67%.

Prospect Capital’s shares have not yet rebounded from the sell-off leading up to the dividend cut announcement in August. Income investors may want to think about Prospect Capital as an opportunistic income play, not as a long-term financial commitment. An investment in PSEC yields 10.7 percent. Prospect Capital Corporation (PSEC) is an interesting player in the Financial space, with a focus on Asset Management. The stock has been active on the tape, currently trading at $6.68. Given the stock’s recent action, it seemed like a good time to take a closer look at the company’s recent data.

PSEC: 5 years historical graph with some technical indicators

Disclaimer: The views, opinions, and information expressed in this article are those of the authors and do not necessarily reflect the official policy or position of any company stakeholders, financial professionals, or analysts. Examples of analysis performed within this article are only examples. They should not be utilized to make stock portfolio or financial decisions as they are based only on limited and open source information. Assumptions made within the analysis are not reflective of the position of any analysts or financial professionals.